In the financial world, the term “digital currency” is often synonymous with the revolutionary concept of cryptocurrency. But how does cryptocurrency work? At its core, cryptocurrency is a type of currency that uses cryptographic techniques to secure transactions, control the creation of additional units, and verify the transfer of assets. Unlike traditional currencies issued by central banks, digital currencies operate on a decentralized network of computers. This decentralization means no central authority, like a central bank or government, controls them. Cryptocurrencies are more than just a digital asset, they represent a technological leap in how we think about and interact with money. Unlike most traditional internal investments, such as stocks or bonds, cryptocurrencies offer a unique blend of technology and finance. Their value is not backed by a physical commodity or a central authority but by the trust and acceptance of the users in the network.

At EssayPro, students and researchers can find research papers for sale, providing a convenient solution for those who need high-quality, scholarly written work on various topics. This service ensures that each research paper is meticulously researched, thoroughly analyzed, and written to meet the highest academic standards, offering an invaluable resource for anyone looking to enhance their academic or professional knowledge base.

The Role of Blockchain Technology in Cryptocurrency

Technology is the backbone of how cryptocurrency works, with innovations like blockchain providing a distributed ledger that records all transactions across a network of computers. This foundational technology ensures the security and integrity of the transaction record, making it nearly impossible to alter any single record without altering subsequent blocks in the chain. Such characteristics make this technology incredibly secure and trustworthy. For those interested in the mathematical algorithms and calculations that underpin this technology, resources like calculatorprofessional.com can be invaluable. This site offers tools and insights into the complex computations that ensure the functionality and reliability of cryptocurrencies, highlighting the critical role of technology in the digital currency landscape The process of adding transactions to this ledger requires computing power, a process known as cryptocurrency mining. Miners use their computing power to solve complex mathematical problems that validate and record transactions on the blockchain. In return, they are rewarded with newly minted crypto assets. This process, known as proof of work, is fundamental to maintaining the blockchain’s integrity and security.

How Cryptocurrency Transactions Revolutionize Digital Trade

Cryptocurrency transactions are a significant departure from traditional financial systems. They allow for direct transfers between parties, using private and public keys for security. This system eliminates the need for middlemen, like institutions, reducing transaction fees and improving transaction speed. One of the most appealing aspects of cryptocurrency transactions is their potential to democratize the financial system. They allow anyone with an internet connection to participate in the cryptocurrency market, regardless of their location or access to traditional banking systems. This inclusivity has opened up new opportunities for online payments and remittances, especially in areas underserved by traditional banking.

Navigating the World of Crypto Exchanges: A Beginner’s Guide

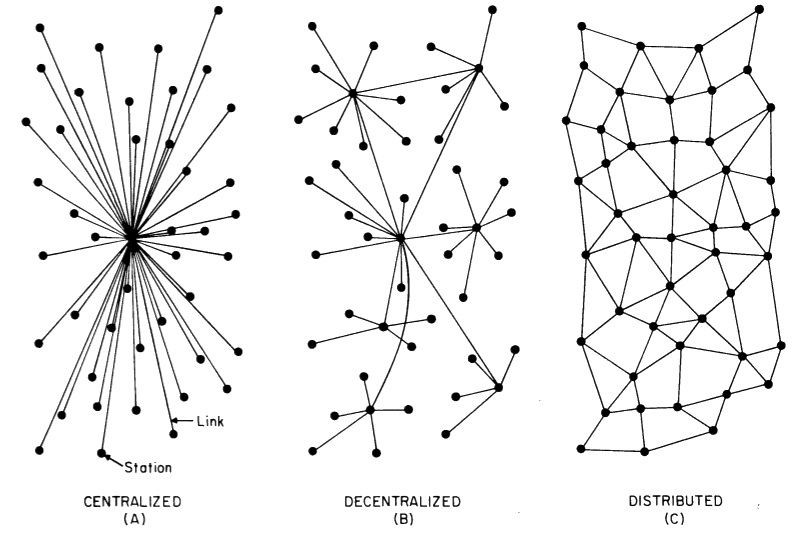

Exchanges are platforms where individuals can buy, sell, or exchange cryptocurrencies for other digital currency or traditional currency like US dollars or Euros. For those new to the cryptocurrency world, understanding the difference between various types of exchanges, such as decentralized exchanges and traditional cryptocurrency exchanges, is crucial. Decentralized exchanges operate without a central authority and allow users to conduct peer-to-peer transactions. On the other hand, traditional cryptocurrency exchanges are operated by companies that provide a platform for trading cryptocurrencies. Many cryptocurrency exchanges also provide a digital wallet service to store cryptocurrency, making them a one-stop-shop for crypto purchases.

Security and Privacy in Digital Currency Transactions

The security of transactions relies on cryptographic techniques. These techniques ensure that transactions are secure, immutable, and protected from fraud. Each transaction is recorded on the blockchain, creating a transparent and tamper-proof record. However, the onus of security also partly falls on the users. It’s crucial to use a secure digital wallet and practice safe storage and transfer methods. Users should be aware of the risks involved in trading cryptocurrencies and take steps to protect their cryptocurrency funds. Privacy is another significant aspect of transactions. Unlike traditional bank accounts, where financial transactions are tied to personal identities, cryptocurrencies provide a higher degree of anonymity. This feature has made cryptocurrencies popular for online payments, but it also raises concerns regarding illegal activities and regulatory challenges.

The Impact of Blockchain Technology on Financial Systems

Blockchain technology is not just transforming how cryptocurrency work, it’s revolutionizing the entire financial sector. By enabling secure, transparent, and efficient transactions, blockchain is challenging traditional institutions to innovate and adapt.Financial institutions are exploring blockchain technology for a variety of uses, from streamlining payment systems to improving asset ownership records. The technology’s potential to reduce fraud, lower costs, and increase transaction speed is making it an attractive option for traditional financial systems.

Real-World Applications of Cryptocurrency Transactions

Cryptocurrency transactions, far surpassing their initial role in trading on crypto markets, have blossomed into a multitude of real-world applications. These digital currencies are revolutionizing traditional financial transactions, offering a new, decentralized form of payment that is rapidly gaining acceptance worldwide. Notably, cryptocurrencies are becoming a popular method for remittances, offering a faster and often cheaper alternative to traditional bank transfers, especially in cross-border transactions. This feature is particularly beneficial for migrant workers who wish to send money back home to their families in different countries. In the realm of commerce, an increasing number of companies across various sectors are beginning to recognize the potential of cryptocurrencies to reach a global customer base. From small online retailers to large corporations, businesses are integrating crypto payment options, allowing customers to purchase goods and services using digital currencies. This move not only caters to a growing segment of crypto-savvy consumers but also enhances the companies’ reputations as forward-thinking and technologically advanced.

Future Trends in Crypto Exchanges and Digital Currencies

The future of crypto exchanges and digital currencies looks promising but is also shrouded in uncertainty. With the increasing adoption of cryptocurrencies, we can expect to see more innovative services and products in the crypto industry. Decentralized finance (DeFi) is one such area that is gaining traction, offering a range of financial services without the need for traditional financial intermediaries.

However, the growing popularity of digital currencies also brings regulatory challenges. Governments and regulatory bodies, like the Securities and Exchange Commission and the Internal Revenue Service, are keen to establish frameworks to oversee the crypto market. These regulations are necessary to protect investors and maintain financial stability but could also impact the decentralized nature of cryptocurrencies.

In conclusion, the world of digital currencies and blockchain technology is complex and ever-evolving. From revolutionizing the way we process transactions to challenging the traditional financial systems, cryptocurrencies are more than just an investment vehicle, they’re a glimpse into the future of money. As we continue to explore and innovate in this space, it’s important to stay informed and adapt to the changing landscape of digital currencies.